One summer, when my two oldest kids were teens, we were casually chatting about college. We were wondering aloud where they might attend, and talking about dorm life, and what it’s like to get an apartment, choose your class schedule, and do your own grocery shopping.

Suddenly, I had this moment of panic about teaching my kids to create a monthly budget. They earn money, and spend money, and save money, but at the time, I had never really talked them through a full monthly budget and what it’s like to live within one. I had this compelling I NEED TO TEACH THEM THIS RIGHT NOW BEFORE IT’S TOO LATE feeling. Hah!

So I sat down at my laptop and came up with a teen budgeting game/challenge. It’s a rough-draft sort of thing, but it turns out they really enjoyed going through it. A year has passed, and we’re still talking about the budget game, and getting requests from the younger kids for their turn.

What’s the challenge? Essentially, it’s a game that takes about an hour to play, where they go through 12 months of budget, and each month they have new challenges thrown their way. The goal is to go through all 12 months of pretend budgets and end with a minimum amount in pretend savings, plus a certain number of pretend “Social/Mental Well-Being Points” (more on those in a bit). I created a Budget Worksheet to help us play, plus a sheet of “Banker’s Instructions” and an explanation of “Budget Options” (you can download all 3 below).

This budgeting game was designed to boost my teens’ awareness of consequences that come from money management (or mis-management), based on things that they value (like their favorite chocolate milk). What do I mean? I’ll explain. And I promise, it’s actually way more fun than it sounds.

How to Set-up your Teen Budgeting Game

First up, I set the scene: They have moved out of the house and are earning $300 per month. In this imaginary world of the game, $300 is enough to create a workable budget. (I realize in reality $300 doesn’t cut it, but it’s a good round number to work with for the sake of this activity.)

Second, I explain there are 9 Budget Categories: 1) Savings, 2) Rent + Heat + Electricity + Internet, 3) Food, 4) Car + Gas + Insurance, 5) Cell Phone + Service, 6) Movies + Shows + Entertainment, 7) Eating Out + Coffee Shops, 8) Clothes, and 9) Miscellaneous. I want to note here: You may pick completely different categories for your particular kids. Maybe you wouldn’t include Eating Out or Clothes. Maybe you’d add in a video gaming category, or a category for medical costs. Maybe you’d replace the car category with a bike category. Think about what foods, and tech, and objects that your specific kids are into and customize the game to fit their motivational needs.

Each budget category has different rules that apply, so I go through the Budget Options sheet with them and they keep it handy for reference throughout the activity. This is where their eyes started to light up. Here are the contents of the Budget Options sheet:

——-

BUDGET OPTIONS

Instructions: Choose ONE of the three money options listed for each category, and create a budget, keeping within your income of $300 per month. Pay attention to the notes on each category, and get additional instructions from The Banker as you start each new month.

SAVINGS

$20

$30

$40

RENT + HEAT + ELECTRICITY + INTERNET

$55 – This is roommate + walkup (no elevator) apartment. The wifi is intermittent and borrowed from neighbors or nearby coffee shops.

$70 – This is studio apartment + elevator, with “OK” wifi (but not good enough to watch videos).

$85 – This is 1 bedroom apartment, plus a community pool and workout room, and hi-speed wifi.

Note: Once you pick a rent amount, you can’t switch rent level till month 7.

FOOD

$40 – You’re eating the most inexpensive foods you can find. Lots and lots of ramen, tuna casserole, and frozen pot pies.

$60 – You can afford fresh veggies, plus a good protein dish (like chicken or beef or fish) for one meal each day.

$80 – You’re buying your groceries from the luxe grocery store. All your favorites. All the best quality. Like steak, fresh guacamole, and the best chocolate milk.

NOTE: If you eat at the $40 level for 3 months in a row, you get sick and miss half your earnings for the following month.

CAR + GAS

$25 – You have an embarrassing, unreliable car and you need to use alternative transportation half of the time.

$30 – You have a boring but reliable car.

$40 – You have a hipster, reliable and NEW car.

CLOTHES

$20 – one new item

$30 – two new items

$40 – three new items

6) CELL PHONE + SERVICE

$10 – You’ve got the crappiest smart phone with limited data – you can only send 100 texts each month.

$15 – You’ve got a boring cell phone, with reasonable data.

$20 – You’ve got the newest iPhone, with reasonable data.

Note: You can’t switch plans till month 7.

MOVIES + SHOWS + ENTERTAINMENT

$5 – You get rentals from the library, and can see one movie in the theater.

$10 – You can go to one music concert, and one movie in the theater.

$15 – You can go to two movies in the theater, one music concert

Note: This category earns you Social/Mental Well Being Points. $5 is worth 2 points, $10 is worth 4 points, and $15 is worth 6 points.

EATING OUT + COFFEE SHOPS

$15 – You can eat two fast food meals each week.

$25 – You can eat two fast food meals each week, plus two restaurant meals each month.

$40 – You can eat two fast food meals each week, plus two restaurant meals each week.

Note: This category earns you Social/Mental Well Being Points. $15 is worth 2 points, $25 is worth 4 points, and $40 is worth 6 points.

MISCELLANEOUS

$10

$20

$30

Note: You don’t get to choose this one. It goes in order and repeats. $10 in month one, $20 in month two, $30 in month three, then $10 in month four and so on.

GOAL

End with over $450 in savings and Social/Mental Well Being factor of 96 or higher.

——-

Third step. Once we’ve read the Budget Options, it’s almost time to get started. But before they jump in, I tell them I’m the Banker and I have a set of instructions that I’m going to follow, and those instructions include special circumstances for each month. The kids can’t read the Banker’s Instruction sheet. The instructions there are meant to surprise them. Here’s the content of the Banker’s Instruction sheet:

——-

“Banker’s Instructions” for the Teen Budgeting Game

This is just a guideline. Adapt as necessary to make it more, or less, challenging.

MONTH ONE: Player should create a budget, forecast their savings, and predict their social/mental well-being points.

MONTH TWO: Player should create a budget, forecast their savings, and predict their social/mental well-being points. Player earns $5 interest on their savings.

MONTH THREE: Player should create a budget, forecast their savings, and predict their social/mental well-being points. Player earns $5 interest on their savings. Player is fined $50 for a traffic ticket.

MONTH FOUR: Player should create a budget, forecast their savings, and predict their social/mental well-being points. Player earns $5 interest on their savings. Player receives a $10 birthday gift.

MONTH FIVE: Player should create a budget, forecast their savings, and predict their social/mental well-being points. Player earns $5 interest on their savings. Player is fined $100 for overdue taxes, and must pay it using credit, which he/she will need to pay back.

MONTH SIX: Player should create a budget, forecast their savings, and predict their social/mental well-being points. Player earns $10 interest. Player must pay 25% of their debt, plus $10 interest.

MONTH SEVEN: Player should create a budget, forecast their savings, and predict their social/mental well-being points. Player earns $10 interest on their savings. Player must pay 25% of their debt, plus $10 interest.

MONTH EIGHT: Player should create a budget, forecast their savings, and predict their social/mental well-being points. Player earns $10 interest on their savings. Player must pay 25% of their debt, plus $10 interest.

MONTH NINE: Player should create a budget, forecast their savings, and predict their social/mental well-being points. Player earns $20 interest on their savings. Player must pay the final 25% of their debt, plus $10 interest.

MONTH TEN: Player should create a budget, forecast their savings, and predict their social/mental well-being points. Player earns $20 interest on their savings.

MONTH ELEVEN: Player should create a budget, forecast their savings, and predict their social/mental well-being points. Player earns $20 interest on their savings.

MONTH TWELVE: Player should create a budget, forecast their savings, and predict their social/mental well-being points. Player earns $20 interest on their savings. Player receives $10 holiday bonus.

——-

How to Play the Teen Budgeting Game

Fourth, they start budgeting. They total each month and make sure they’re staying within $300. They check the budget notes and make sure they’re following along. They add up their Savings and Social/Mental Well-being points. They check in with me (the Banker) as they go so I can tell them what their challenges are for the next month based on the Banker’s Instruction sheet, and I adapt the month’s challenges as necessary. (Knowing I want this to be a positive learning experience, I put the goals within reach. But I can make it harder or easier depending on the mood they’re in.) I’ve got a worksheet here that you can download that will help them create their budgets.

Last step? Add up the final numbers and see if they’ve met their goals! I didn’t offer prizes, but taking them out for a milkshake wouldn’t be a bad idea.

And now a few quick notes: Yes, yes, I know. It’s not perfect! And you would do it differently (and better!). And your kids would totally forego new clothes! And going to movies doesn’t really give you mental well being! And eating ramen for 3 months won’t necessarily make you sick! This is all true. I totally believe you. And I promise you can adapt this any way you like. I definitely created this with my specific teens in mind, trying to come up with details that might appeal to them. Your teens might relate to completely different categories. And if you’re doing this with younger kids, I recommend you involve MineCraft somehow.

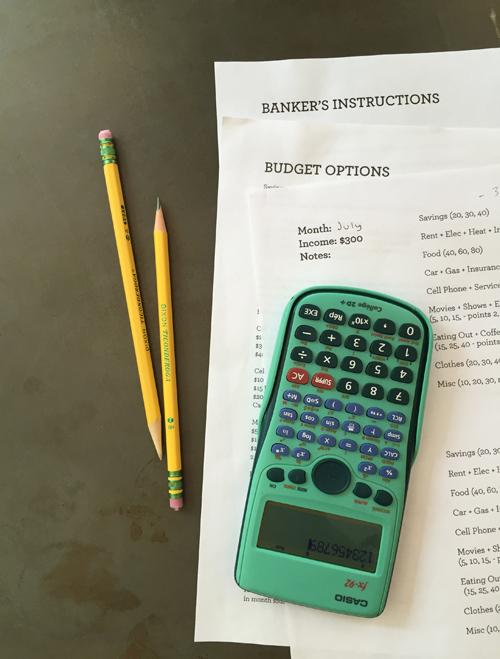

Now back to today. I can tell you, I wasn’t sure if the kids would be in to it, but they totally were! They LOVED the challenge. I stuck mostly to the Banker’s Instructions as listed, but threw in a couple of extra challenges when necessary. I did the activity first with Maude, and then with Ralph, and it took about an hour each time to get through all 12 months (I recommend having a calculator nearby to help speed things up). I don’t pretend it made them budgeting geniuses overnight, but it generated lots of good discussion.

I hope it communicated the ideas that yes, you can spend every dime you earn and never save, but there are real negative consequences when you do. And alternatively, yes, you can eat the bare minimum and live like a miser, but there are real negative consequences when you do. The goal is a reasonable, healthy, monthly budget. It might not happen every month, but it’s the goal. I hope this budgeting game also communicated some basic social awareness — reminding them that not everyone has access to things like decent food, and that can create health problems.

Think your kids would enjoy this? Feel free to download the sheets I created (free download!), and you can adapt them for your family however you like. Print the worksheet (page 3) six times and you’ll have 12 months of workspace.

Okay. Now I’m dying to hear. Have you had any breakthroughs teaching budgeting to your kids? Would your kids be into something like this? Are your kids savers or spenders? (I have some of both.) Do your kids save for anything in particular? Like for a car or for college? I’d love to hear!

Credits: Photo and text by Gabrielle Blair.

This is awesome!! I am hoping to use this for my Life Skills group on an inpatient psych unit for adolescents! :) It may be a little much to ask of them but I’m going to try to modify a bit. Really awesome concept!

I’ve taught Dave Ramseys Financial Peace University 9 week course several times. Your activity gives “every dollar a name or purpose-PERFECT!!!! I’m teaching a budgeting class for teen girls at a church camp this week…this is PERFECT-THANK YOU!!!!

Thank you so much for sharing this. I am working on teaching money management to my teenage daughter and this is just perfect!! She loves that it is in game format and says she can’t wait to “win” the challenge.

so at the end of the month if there is funds left over does it just go in savings? or do you roll it over?

How do you earn the wellbeing points?

This is a great way to convey the message of a budget. I have a classroom full of students to share information about how to budget. Would I be allowed to share this information as long as I gave credit to you?

Planning to use this game in my Creative Home Ec homeschool class this year. Thanks so much for sharing it so I don’t have to reinvent the wheel!

So I was going through this with my HS students to introduce the budgeting chapter.

The savings part got a bit confusing. Since I cannot see how the calculations went, it makes it difficult to see how to explain it. Do we do a running total? Especially with left overs that we did not spend?

What a fun game! I especially like the add-ins like if you eat cheep food too many months you’ll get sick. I wish my parents taught me about budgeting when I was a teen. It’s such an important skill!

This is awesome!

My kids are loving this! Thank you so much! Our edit was to add 6 points for selecting the highest rent category because my kids argued that they would socialize and exercise at the included gym and pool.

I work with homeless and at risk of homelessness young people aged 12-25. I just know this game will hold their attention (so hard for kids who are disengaged from community), and teach them invaluable skills. I’m going to adapt the total income amount to the minimum dollar value received from our social security system here in Australia.

Thank you for the work you do and for sharing it. I’m grateful.

Used it, liked it, suggestions for improvement: students were confusing the Amount saved with the savings. Also, put in a balance forward line on the right side per month so they could keep track of how much $ they had already saved and how many points so far….

right side column–budget total (must be $300 or less) _____

amount saved (remainder of the $300) _________

Amount saved plus “savings” amount ___________

One student suggested that one should get some mental well-being points when paying for the most expensive auto and the most expensive apartment rental and the best cell phone service. I think 2 points each for that. Will try the next time I use the activity…

I am a FACS middle school teacher. I am using this right now in my classes. I love it!!! I was looking for a fun way to teach them budgeting and you already did the work for me. Thank you! By the way, I homeschooled my own children and was home with them for 12 years until this year! Blessings!

Pingback: 11 Budget Games (Free, Online, and Board Games)

I played this with kids in my class and they loved it! Some ideas they had were to add categories like toiletries, haircuts, etc. Also more unexpected events and curveballs!

I changed the $$ amounts to reflect realistic costs of rent and such which made it a bit more true-to-life but required a bit of adjusting.